All the mortgage industry experts agree on very few things

But since the 2008 financial crisis and the resultant HVCC the following year, it seems every article about appraisal management or compliance has begun with a sentence similar to this:

“The appraisal industry has changed dramatically.”

In fact, rapid and continual change are the only constants in our industry and it’s a common complaint for most lenders. But, now smart institutions can easily adapt and perform far more competitively than their competitors and do so less expensively than they might think.

When managing appraisal QC, many lenders and appraisal management companies (AMCs) try to solve the wrong problem. Instead of desperately trying to keep up with new guidelines and requirements your organization can work smarter by implementing a PROCESS which allows you to be agile and flexible. Your ability to quickly adapt to change can become a competitive advantage. To do that effectively, it’s the SYSTEM you have in place that matters. You need a consistent and efficient infrastructure that enables you to thread the needle of effective, well-documented, quality control, while also maintaining strict legal compliance.

Regulatory Overview

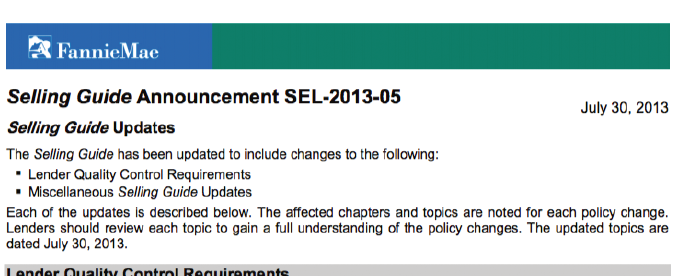

After this white paper was first published, Fannie Mae issued new QC requirements that directly affect your appraisal operations. Pre-funding, investors and regulators want every appraisal to undergo a documented, consistent QC process.

Announced in July, Fannie Mae adds pre-funding QC process and documentation requirements

The Selling Guide Announcement issued July 30 focuses on quality control requirements to reduce repurchases. The full list is long, but we’ve isolated a few of the specific requirements that many lenders and AMCs don’t have in place yet:

- Your QC program must be documented and incorporate systems and processes for achieving your QC standards.

- Your program must specify the location of QC findings and all related QC documentation. This requirement eliminates the mental checklist or spreadsheets that many use. In repurchase requests or exams, they’re looking for a documented QC audit trail.

-

You must develop severity levels to categorize defects. They’re requiring this type of scoring, but it’s a good idea to implement anyway. QC scoring with severity levels is useful to streamline your internal operations since you can more effectively triage files to the appropriately experienced underwriters for each score range.

-

You must report on QC findings monthly to senior management. Without a consistent QC process and system, meaningful reporting will be very difficult. Trends and overall findings of all your QC staff can’t be determined without a standard process that eliminates as much subjectivity as possible.

-

Your QC process has to include stated data and documents, so you can ensure the data relied upon in making the underwriting decision is accurate. This last requirement makes clear that these new standards apply to a review of the appraisal.

The full Selling Guide Announcement can be found here: https://www.fanniemae.com/content/announcement/sel1305.pdf

Announced in September, UCDP expands to include QC messages

Their requirements will eventually be enforced through the submission platform, Uniform Collateral Data Portal, or UCDP. The Fannie Mae UCDP Release Notes from September 24 let us know it’s coming faster than most expected, and they’re probably in place by the time you read this. The full Release Notes can be found here: https://www.fanniemae.com/content/release_notes/ucdp-release-notes-11092013.pdf.

For now, these are warning messages and won’t prevent a “successful” UCDP submission, but warnings will transition to errors. When you take a look at these messages, you’ll quickly see the GSEs’ focus is emphasizing pre-funding quality control and consistency. Here’s just one example:

"FNM0189: The appraiser indicated a condition rating for the subject property of C3 or greater. However, the age and update history of the subject property appear to support a condition rating of C1 or C2. Verify that the reported condition rating and actual age of the property are accurate."

What’s coming: UCDP’s future QC focus

Investors have spoken at industry conferences, frequently stating that UCDP warning messages that will go even further, and provide a comparison of data aggregated across the entire platform from various appraisers. An example of these types of warnings would look like this:

"The appraiser indicated a condition rating for the subject property of C2. 83% of appraisers have rated this property a C3. Verify that the reported condition rating is accurate."

In addition, “self-discrepancies” will be noted. Examples of these types of warnings could look like this:

"The appraiser indicated a condition rating for the subject property of C2. The same appraiser used this property as a comparable in another assignment with a condition rating of C3. Verify that the reported condition rating is accurate."

The Selling Guide Announcement referenced on page 4 gives a good overview of their requirements, but seeing the actual warnings and errors they’re planning to give you when you submit an appraisal gives us a really good idea of what the GSEs expect your QC process to uncover.

Several other guidelines pertain to your appraisal QC process, as well. Dodd-Frank’s appraisal rules can be found in subtitle F of Title XIV of the Act, titled “Appraisal Activities”.(http://www.law.cornell.edu/uscode/text/15/1639e) Section 1472, Appraisal Independence Requirements (AIR) establishes some common sense compliance guidelines designed to prevent collusion. Most of these were also required by HVCC (http://www.freddiemac.com/singlefamily/pdf/122308_valuationcodeofconduct.pdf ) so they’ve been well documented in the industry and should be familiar to most.

The Consumer Financial Protection Bureau is charged with overseeing the rules and enforcement of the Dodd-Frank Act and we know they are still issuing final rules while gearing up for enforcement. It’s critical to examine your current process with enough time to make internal changes for compliance before the January 2014 effective dates.

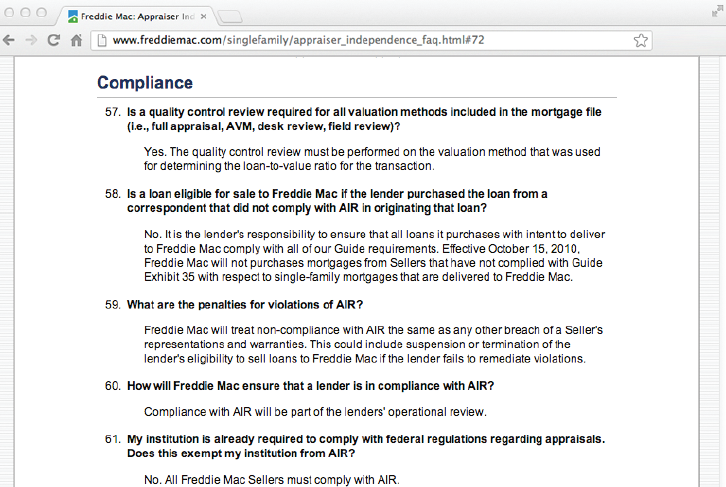

We know investors will also adopt the same quality control requirements as the regulators are, at a minimum. For one example, see Freddie Mac’s Appraiser Independence FAQ, shown below, regarding the necessity for an appraisal quality control process. Freddie Mac’s full AIR requirements can be found here:

http://www.freddiemac.com/singlefamily/appraiser_independence_faq.html

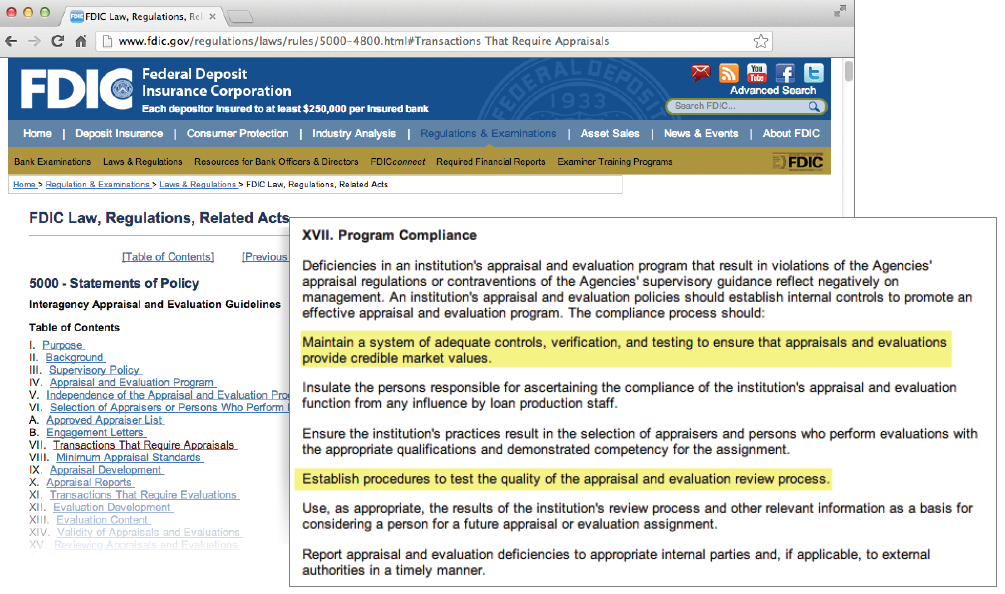

The FDIC also requires consistent quality control procedures for appraisals. See their Statements of Policy, section XVII. Program Compliance, shown below. The FDIC Statements of Policy can be found here: http://www.fdic.gov/regulations/laws/rules/5000-4800.html

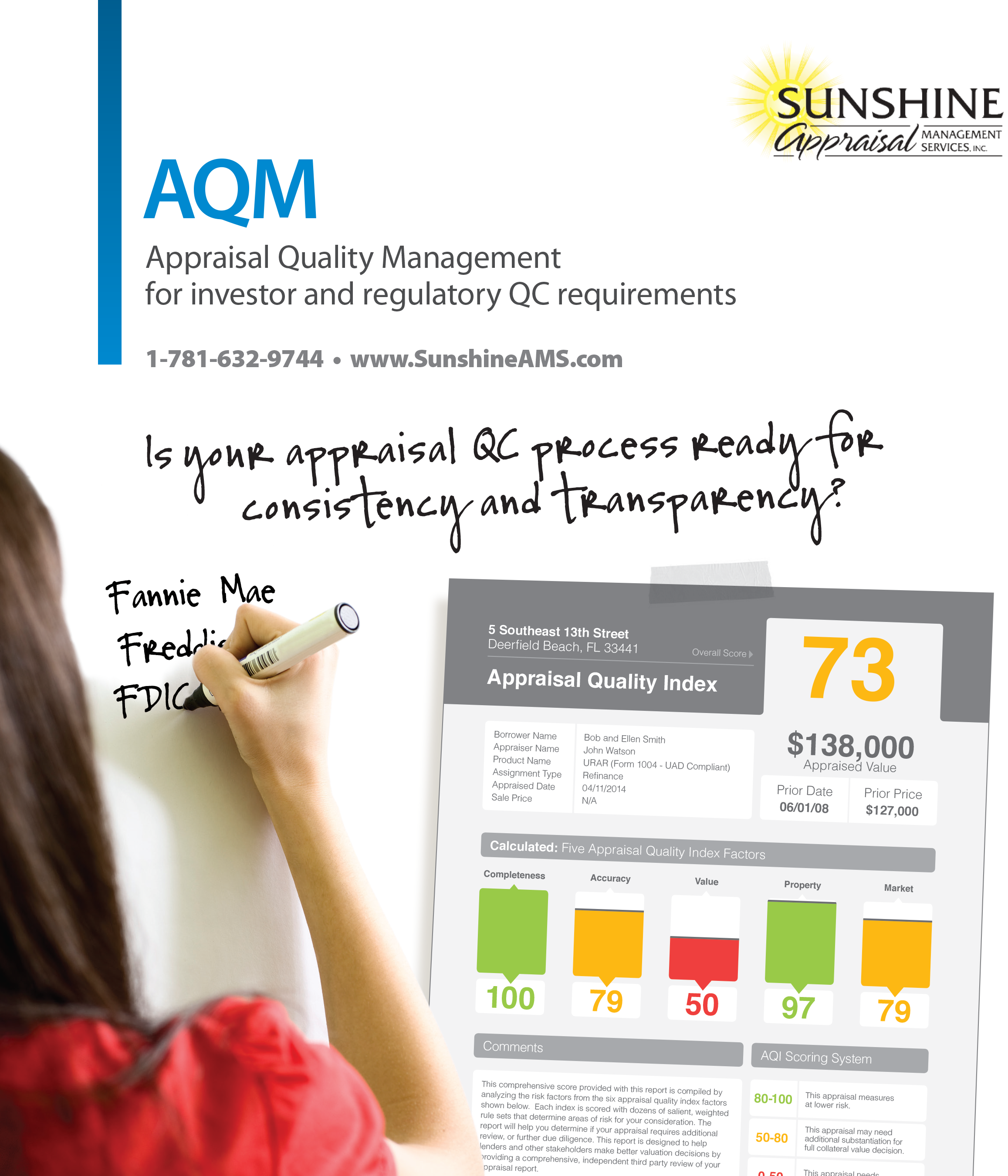

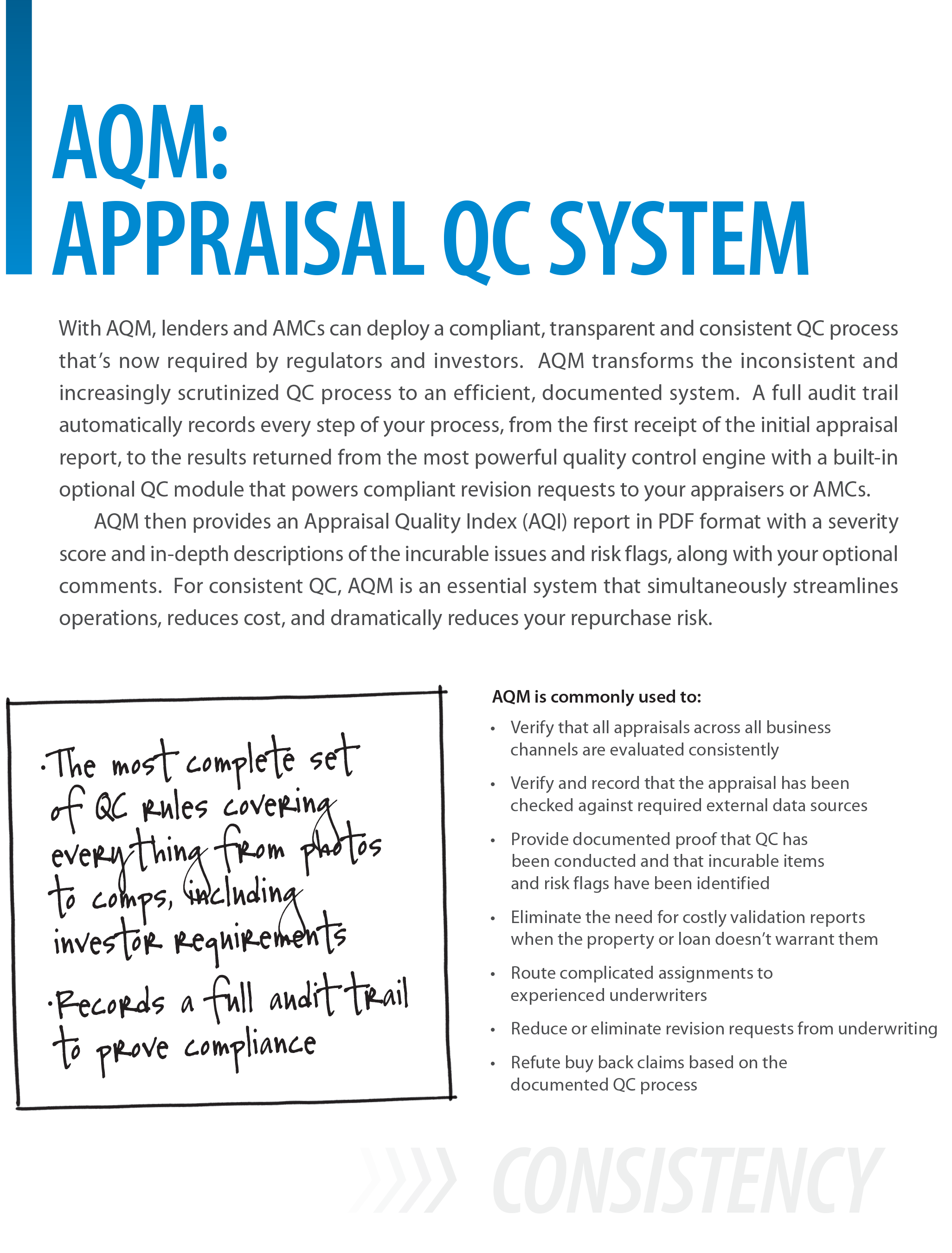

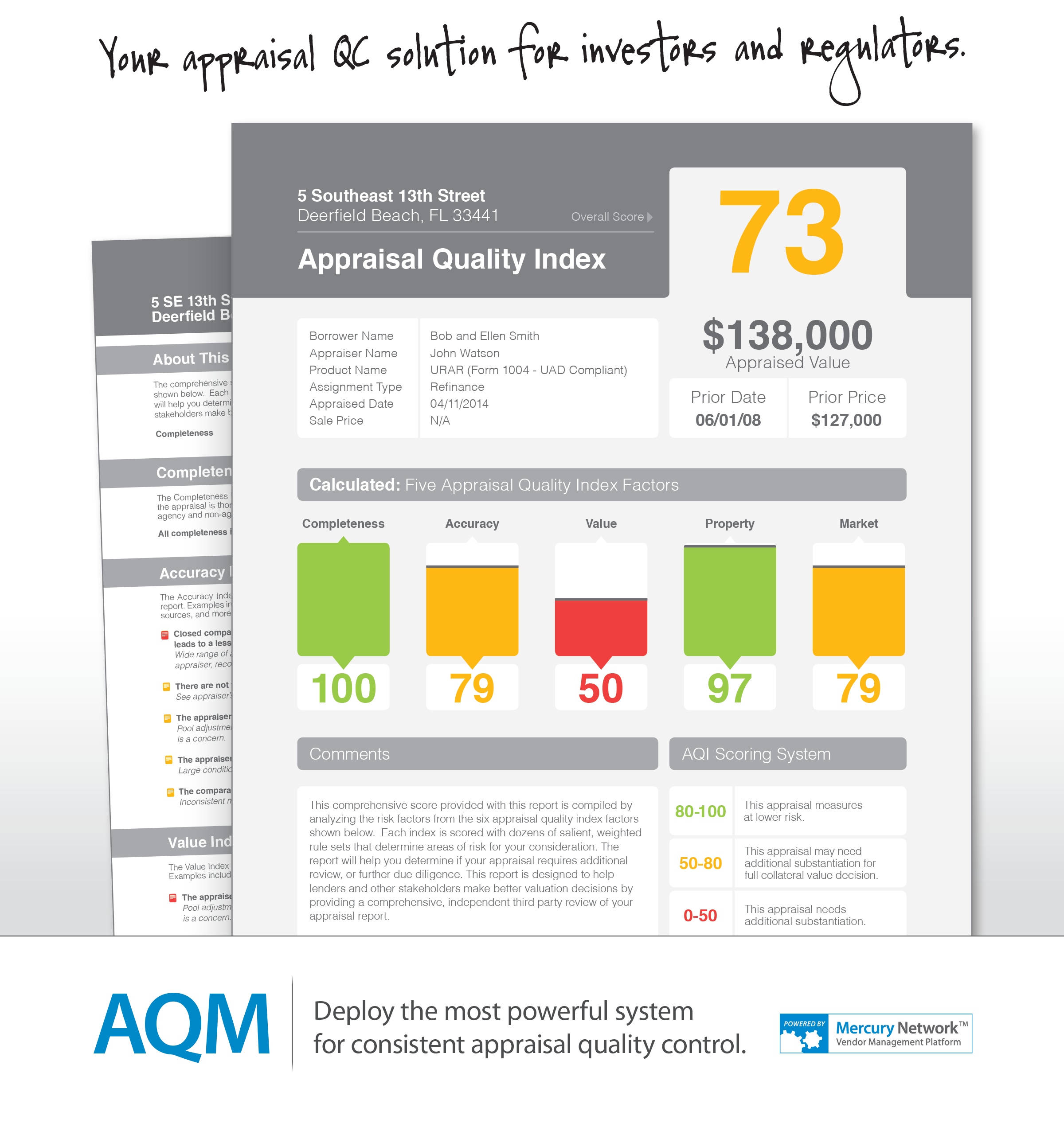

Accordingly, Sunshine utilizes a thorough QC software (AQM). With AQM, we are able to provide graded QC reports to our clients.

After the new compliance mandates and increasing investor requirements, appraisal QC is more important than ever.

The AQM system is a hub for all your appraisal QC and services. It documents your entire QC process, provides an easy workflow system to quickly process the required due diligence on all appraisal reports, and even deploys a powerful vendor communication platform to accelerate your revision cycles.

Benefits of AQM:

- Ensures comprehensive, consistent quality control for appraisals across all business channels

- Empowers you with thousands of automated QC rules, plus you can access third party QC tools and even add your own rules

- Creates an automatic audit trail to prove your compliance with regulations and investor guidelines

- Generates an AQI score and report, so you can effectively triage reports to the appropriate underwriters and highlight the critical issues for their consideration

- Provides an easy workflow dashboard that guides your staff through a compliant QC process, including an integrated platform to collaborate directly with the appraiser

- Accelerates revision cycles with easier, faster vendor communications

- Eliminates redundant work, unnecessary extra products, and additional expenses

- Reduces expenses, without locking you into any contracts or commitments